$500 Payday Loans Online No Credit Checks

If you need money, $500 payday loans could aid you in tackling short-term issues. If you’re searching for legit cash advance loans, you will likely find many options. Don’t be discouraged. It is possible to obtain an instant $500 loan and receive the cash in your account through direct deposit in just one business day. No matter your credit score, you can apply online for approval for cash loans without a credit check! Our online application and instant approval process makes getting a loan a breeze.

What Is Exactly a $500 Dollar Loan?

A payday loan of 500 dollars is a loan that you could apply for in an emergency, such as emergency expenses. In most cases, you can repay the loan in one month. Most states limit the period to 30 days. Paying the Loan on time is important to avoid additional fees. Direct lenders can permit customers to extend their repayment time in some states. The loan application process is straightforward, and if approved, the loan agreement will clearly outline the terms and conditions. You’ll need a source of income, like a monthly income, to qualify for a $500 loan and have an active checking account for the funds transfer. So, follow the application process closely to quickly secure your loan.

This reduces the risk of the borrower incurring late penalty charges for late payments. Ask your lender directly regarding this. If you are approved (most are), the money should be in the banking account on the next day of work. The high approval process rate for a 500-dollar online loan is an enormous advantage. Anyone with bad credit borrowers or no credit can get the $500 payday loans offered by an online lender and receive quick cash advances.

What Types of $500 Dollar Dollar Loans Can I Apply For?

A personal loan, installment loan, or Bad credit payday loans may be the best choice for you based on your current financial situation and the money you need to borrow. These loan offers have various loan terms, Annual Percentage Rate (APR), loan fees, and loan interest rate. When considering these options, choose the one that best fits your needs, particularly during financial emergencies. Remember that unsecured loans usually have a faster loan decision, making them a suitable option for a fast cash solution.

When a borrower desires a set monthly payment for an extended period of time, an installment loan will be the best option. Paying back the debt in equal monthly payments or sections until you repay the whole amount is possible with a $500 direct-lender loan.

Payday loans from RixLoans have a short payback period. Therefore, the amount must be repaid on the next payday, along with interest and other costs. Some financial products like credit cards and cash advance loans can offer different repayment options to borrowers. This variety allows borrowers to choose a loan contract that suits their financial needs.

In our commitment to providing accessible financial solutions, we are proud to serve customers in the following American states. Whether you’re in need of a $500 payday loan or other financial assistance, our company is dedicated to assisting you. Please refer to the table below for a comprehensive list of states where our services are available.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

What Is the Best Way to Use a $500 Payday Loan?

The following are some of the most common uses of $500 payday loans:

- Emergency cash: A payday loan can be a good option to cover unexpected expenses, such as car repairs or medical bills.

- Online cash advance loans: If you need a short-term financial solution, same-day approval for online cash advance loans can help you manage your finances until your next paycheck.

- Cash advance apps: These apps can provide a fast way to get a loan if you need to make a purchase or have an unexpected expense, thus saving you from late fees and overdraft charges.

- Direct payday lenders: Applying for a loan from direct payday lenders can also provide a quick solution to cover urgent expenses.

- Proof of income: Many lenders require borrowers to provide proof of a regular income to be eligible for a payday loan. This ensures that they can repay the loan during the agreed repayment period.

In conclusion, understanding your financial needs and exploring different options, such as cash advance loans, credit cards, and direct payday lenders, can help you make the best decision when seeking short-term financial assistance.

- Payday advances are used when you have a short-term cash flow problem. You may be having trouble paying your bills on time or facing unexpected expenses such as medical bills, car repairs, or home improvements. A $500 advance will allow you to pay off these debts quickly so you don’t fall behind on payments.

- If you are looking for extra money to make ends meet during a difficult period, then a $500 payday loan could be just what you need. This type of loan provides temporary relief from debt and is an alternative to title loans, which require collateral. Loan cost may also be lower compared to other financing options.

- If you have a bad credit history, you may be unable to borrow money from traditional lenders. However, many companies offer $500 payday and credit check loans to those with poor credit histories, with minimal impact on your record at the major credit bureaus. These loans are ideal for improving your credit score, as they do not carry the same risk as traditional loans.

- If you have had a job loss recently, then a $500 advance could be what you need to tide you over until you find another one, providing you with a more manageable repayment schedule. You should have an active bank account and be able to prove your income sources before applying.

- $500 payday loans typically come with monthly installments for repayment, allowing you to budget more effectively. Make sure to prioritize paying off the loan to avoid additional fees and penalties. Keep in mind that prompt monthly repayments can also improve your credit score.

- If you have a consistent income but struggle with utility bills or other living expenses, a $500 loan might be more flexible than standard bank loans. Evaluate your repayment capacity and select suitable repayment terms before committing to avoid financial stress.

What Are the Procedures to Get a $500 Loan?

The first step to receiving a $500 payday loan is to request one. Begin by filling out the simple, protected online form with the relevant information and the amount you want to take out. After that, click submit, and we’ll review your request within minutes (usually five to six hours), and you’ll get a notification of the outcome! The accuracy of your information is crucial, so ensure you’ve double-checked the information before pressing that submit button.

It’s important to consider the loan type you’re applying for. In this case, it’s a traditional payday loan. Once your submission is accepted, depending on the online lending network and the chosen loan type, we will direct you to your lender, who will explain the conditions and criteria of the loan, including options for secured loans or instant cash advance loans. Some lenders provide same-day funding with direct deposit loans.

Can I Get a $500 Dollar Payday Loan With Bad Credit?

Yes! Many companies offer payday loans to people with bad credit scores or limited credit history. They do require you to fill out an application form online, and they will evaluate your situation based on the information provided. Different credit check options might be available, and your data sent to credit reporting bureaus depending on the lender’s policies. Once approved, they will send you a check or offer a direct deposit within 24 hours.

What Happens if I Do Not Repay My RixLoan Payday Loan?

You must repay your payday loan to avoid facing high-interest rates and additional fees. Understanding the loans with repayment terms before entering any agreement is crucial. If you cannot commit to the repayment plan, exploring other options or discussing your situation with the lender is better. They may suggest alternatives or work with you to find a suitable solution.

You must repay a payday loan from RixLoans to avoid being charged late fees, interest rates, and other charges such as insufficient funds fees. In addition, you may be reported to the credit bureaus, which will negatively affect your credit rating and may involve debt collection agencies.

Do Lenders Guanatee $500 Loans?

There is no guarantee of loan approval from any legitimate lender, including Navy Federal Credit Union or other financial institutions offering loan products. It is not legal to promise that a loan will be approved before someone can file a loan request. However, since Rixloans doesn’t conduct thorough credit checks and may consider alternative data companies and verifiable income sources besides just financial history, your approval odds are higher when you apply for a 500-dollar payday loan with an online lender directly. The quick application process also helps to speed up the approval.

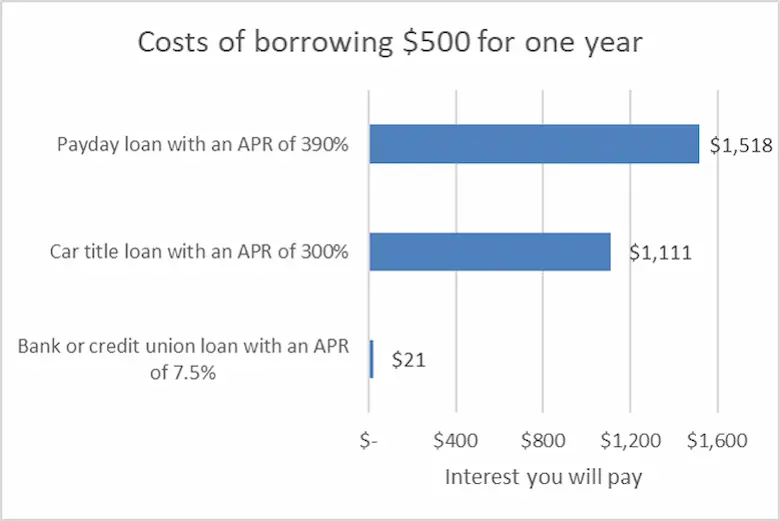

What Is the Cost of a $500 Payday Loan?

The cost of a $500 payday loan varies depending on factors such as credit types, bad credit installment loans, and the lender’s fees and policies. Some lenders might charge prepayment penalties or other fees, while others offer more affordable options than traditional payday loans. To find the best deal, comparing different lenders’ terms and conditions before applying for a loan is essential.

They are usually short-term personal loans you must repay within a month in various states. They can cost between 10 and 30 dollars for each $100 borrowed in all jurisdictions, sometimes including an additional finance charge. Before obtaining a loan, reading and understanding the loan terms is essential. It is essential to ensure that you’ll be able to repay the loan on the due date stipulated in the contract and meet the monthly income requirement and other income qualifications.

Can You Get a $500 Loan in Under 60 Minutes?

You can get your loan approval from RixLoans, a steady source and network of lenders, within a few minutes. However, getting the cash in your bank account may take up to 24 hours. If you apply before 10:00 AM, you may receive the loan within the same day. RixLoans potentially offers Flexible Repayment Terms and a customized repayment plan.

How Can I Get a Bad Credit $500 Installment Loan or Credit Card Cash Advance?

Obtaining a $500 installment loan with bad credit is possible through RixLoans. They may perform a soft credit check and consider other factors, such as your employment status and income, when determining your eligibility. Lenders may also offer Debt consolidation options, making it easier to manage your finances. This stable source of lending can be a viable solution for those with poor credit as long as they meet the lender’s income qualifications and other requirements.

Our direct lending platform online does not require credit scores. You must complete the online loan request form on Rixloans’ website to request a $500 cash or installment loan! We will review the application and reply within minutes to let you know if you qualify for the loan. If you meet the eligibility requirements, you might be eligible for a $500 loan, even without credit or a poor credit score. Our customer support team is ready to help you with any questions or need assistance.

Frequently Asked Questions

I’m hoping to Collect $500 in the Morning Tomorrow. What Should I Do?

In most cases, you may borrow money from family and friends. If they’re willing to provide you with the cash you require, you’re well on your way to getting it. However, if you’ve exhausted your options and are looking for quick relief, a payday loan could be your best choice. No matter your credit score, you can request online and get acceptance for the loan amount you require the next business day. Our instant cash advance app can help speed up the loan decision speed process even further. By working with third-party lenders, we can offer favorable lending terms that may not be available through other sources. Plus, we focus on providing excellent customer service to ensure you have an informed decision when choosing our financing options. In addition, Rixloans works with a network of lenders to provide you with an alternative loan opportunity if you are denied a traditional loan from valid banks. We offer various personal loan amounts without any hidden extra costs so that you can select the most suitable option for your needs.

Can I Obtain a $500 Payday Loan Without a Credit Check?

Yes. The majority of payday lenders do not conduct credit checks. They know that the majority of potential applicants are bad credit. In contrast, they view your earnings history as the most reliable indicator of your ability to repay the loan. Excellent options are available for income borrowers, including instant loan providers and reputable lending networks.

What’s the Cost of a $500 Payday Loan?

The service providers and the state laws determine the cost. Payday lenders usually cost between $10 and $30 per $100 loaned. That means that should you opt for the $500 payday loan, you must spend between $550 and $650. The fees can differ by state, so read the contract thoroughly and contact the lender directly to inquire about the payment of payday loans. Some lenders may offer hardship options if you face difficulty repaying, but an expensive option like a cash advance loan might not suit everyone.

How Much Can I Borrow?

All states offer Payday loans, ranging from $100 to $1000. If you need more, you could request an installment loan (using the same application form on our website), and lenders that offer larger loans will look into your request. One option could be a credit card consolidation loan, which often has lower APRs on loans compared to payday loans. Lenders may also offer various monthly payment schedule options, such as four-week repayment terms or a 2-year repayment term, to fit your financial needs.

What Happens if You Do Not Repay the $500 Payday Loan?

You can pay an additional $35 NSF fee, and your account will be transferred to an agency to collect. The collection agency can relentlessly pursue you; therefore, not paying the loan isn’t the best option. With dedicated customer care, engaging with a reputable lending company that offers favorable terms is important.

The collection agency could even bring a lawsuit against you and seek judgment against you. If you are concerned about being late on a payment, contact your lender as quickly as possible. Many innovative lenders will work with you to design an arrangement that allows you to pay on time and avoid the risk of default, especially if you have a positive payment history. This may include debt management plans or debt settlement options.

Eligibility Criteria for a Payday Loan?

To be qualified for an average loan from cash advance loan companies, you must satisfy the following requirements:

- A resident of the United States must be at least 18 years old to participate.

- Employed and receiving a regular monthly salary

- Valid phone number and e-mail

- There are no recent IVAs or CCJs on your record.

- Rating of the good or fair credit

Before accepting a loan, understand the exact cost and fee structures involved, and always prioritize a lender with excellent customer care.