Arkansas Payday Loans – Bad Credit Near Me

Everyone understands that life is what it is, and sometimes unexpected expenses, like medical bills, happen. If you desperately need money, Arkansas payday loans from RixLoans may be what you require. With a RixLoans loan request, you will not need to go through any credit verification process when looking for financial assistance. RixLoans offers a quick cash solution for those in need.

Why Rixloans Payday Loans?

If you qualify, RixLoans payday loans in Arkansas can provide up to one thousand dollars in fast cash, providing access to cash during financial emergencies. You may apply for cash loans online without ever having to leave the comfort of your home through an easy online application process. It is a simple, quick, and secure method of obtaining a loan to fulfill individual needs. Furthermore, online lenders like RixLoans often offer flexible repayment options.

What Is a Rixloans Payday Loan in Arkansas?

A Rixloans payday loan is a short-term loan agreement designed to promptly provide you with the funds you need, regardless of your credit history. To qualify, you must provide proof of income and have a steady source of income. RixLoans offers a convenient solution for those who need financial assistance quickly and efficiently.

Generally, loans are of two categories: short-term and long-term. Short-term yet high-cost online loans are available through payday loan companies like RixLoans in Arkansas. These loans are a good option for clients who want to borrow money for a short period in exchange for a service fee. They offer limited loan amounts and flexible repayment terms.

For this reason, this type of loan is called a payday loan. The client writes a personal check for the loan amount and the service fee and mails it to the lender’s address. Arkansas Payday loans allow you to obtain rapid cash, even with poor credit. They offer quick approval and various loan products for different clients’ needs.

What Are the Requirements for a Rixloans Payday Loan in Arkansas?

A person must meet specific loan requirements to apply for cash loans online. The applicants should be;

- At least eighteen years old (full legal age)

- Arkansas residents & United States residents (proof of residency)

- Making a steady income (proof of it)

- Email & Phone numbers make the payday loan applications possible

- Having their checking account

- Meeting the minimum credit score requirement, although bad credit borrowers may still qualify for loan offers based on other factors, such as repayment periods and loan approval criteria.

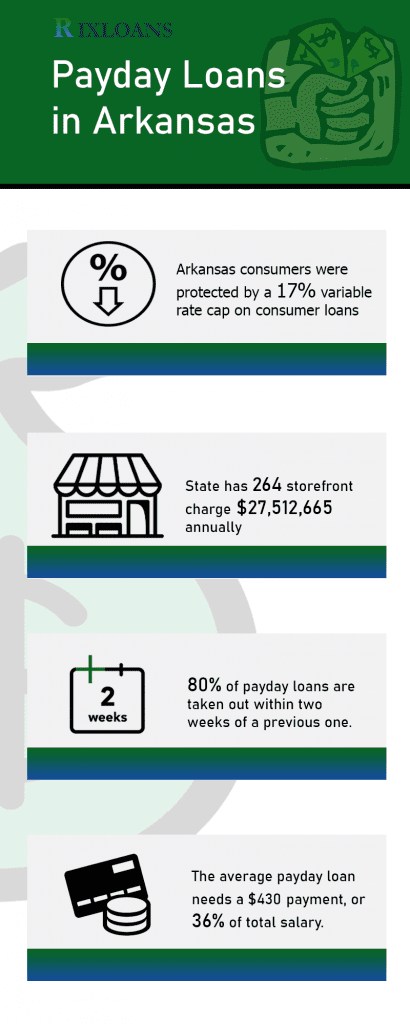

What Are the Payday Loan Rates & Rules in Arkansas?

- Financial advice: Loan Renewals & Rollovers are not allowed, normally

- Access to funds: One day (24h) cooling period

- Maximum loan: Max loan is limited to $500

- Loan option: One loan per month rule

- Loan contract: 10 to 15 dollar fee for every 100 borrowed

- Flexible repayment plans: Durations max. of the loan 31 days

- Minimum one-week loan

- Loan details: Extra finance fees & costs allowed

Important information, Read and check loan terms and conditions before commitment. It is vital to understand what you are about to commit.

How Can I Apply for Rixloans Payday Loan In Arkansas?

The easiest way is to apply online, as it is fast, easy, and available 24/7. To apply for cash loans online, a person must meet the fundamental prerequisites (types of loans) (listed above). Learn the rates and terms and start the process. The online form application process at Rixloans typically takes only 5-10 minutes.

How many payday loans can I get from RixLoans?

With a network of lenders providing a range of loan options, loan access is easier. Discover and explore loan amount options and make informed financial decisions based on your needs.

Consumers in Arkansas are limited to receiving one cash advance per month. They also cannot roll over their debts if they cannot pay them back. Furthermore, no one can get a new loan until they finish repaying an existing one, which takes 24 hours.

Can I Get a Bad Credit Loan Through Rixloans?

Getting loans with a good credit score is always easy, but you can get a payday loan even with bad credit score or poor credit here at RixLoans. Payday lenders are interested in your monthly income rather than your credit status, which makes it a convenient solution for borrowers with access to emergency cash.

Flexible loan amounts and competitive rates offered by bad credit providers make payday loans an ideal choice for those with less-than-perfect credit scores who face unexpected bills.

Payday loans are due on the borrower’s next salary, so the credit score is a partially obsolete parameter. Credit scores are not checked or reported to credit bureaus, but only “a soft credit check could be done. Quick access to quick funds makes it a popular option. Having a high credit score is good as it generally makes life easier.

Why Did Rixloans Deny My Loan Application?

It’s essential to meet all the eligibility criteria when applying for a loan. If they reject your loan application, it might be due to an insufficient credit profile or not meeting the requirements. Reviewing your application and ensuring all details are accurate and up-to-date to increase your chances of approval next time is crucial.

If you do not qualify for an Arkansas Payday Loan through RixLoans, there are various reasons for this denial. The following are the most common reasons your application for Rixloans Convenient Payday Loans was unsuccessful.

- You gave information that is false or erroneous.

- A lack of work experience or a poor employment history

- You did not provide your active bank account details

What Are the Benefits of Borrowing Through Rixloans?

RixLoans distinguishes itself by offering many advantages to its customers compared to other direct lenders. The following is a summary of its most significant benefits.

- Application in minutes: Complete our online application form and receive an instant decision on your loan request.

- Flexible Terms: Tailor your loan repayment plan according to your needs and situation.

- Steady source of funds: Get the money you need to cover emergency expenses, avoid late payments, and handle unexpected financial situations.

- Simple application process: Easily apply for loans and receive funds quickly with our streamlined lending process.

- Loans to customers: RixLoans offers loans with competitive rates, making it a popular choice for individuals looking for short-term financial assistance.

- Informed decisions: Our transparent terms and conditions empower borrowers to make informed decisions about their loans.

- Rixloans loans are the most affordable in terms of monthly payments.

- The rates charged by Rixloans are lower when compared to those set by competitors.

- Rixloans loans have the most extended loan terms of any state.

- A standard loan is short and does not exceed one year, making it ideal for most people.

Our company takes pride in serving customers in various cities across Arkansas. We understand the importance of providing accessible financial solutions, especially when unexpected expenses arise. As we strive to meet the needs of individuals seeking reliable and convenient payday loans, we have expanded our presence in several key cities throughout Arkansas. Below is a table highlighting the most important cities where our company is actively serving customers. We are committed to offering services in these vibrant communities, helping residents overcome financial hurdles and achieve their goals.

| Little Rock | Fayetteville | Fort Smith |

| Springdale | Jonesboro | Rogers |

| Conway | North Little Rock | Bentonville |

| Pine Bluff | Hot Springs | Benton |

| Sherwood | Bella Vista | Paragould |

What Are the Cons of RixLoans Arkansas Payday Loans?

- Payday loans have high-interest rates APR (annual percentage rate)

- Credit scores are not checked or reported to credit bureaus and cannot build your credit score.

- If you have extended-time financial problems, you can drop into the debt cycle

Rixloans – Your Most Convenient Option for a Payday Lender

Everyone has been in a terrible scenario when they have run out of money and faced a gap between paychecks. Rixloans can assist you if you are unsure of where you should go for assistance. We work with the most reputable legit funding sources from many online payday loan providers. Our online platform connects borrowers with lenders offering instant payday loans and hour payday loans.

Whether you need extra cash to cover unexpected expenses or to fill the gap between paychecks, our online cash advance loans can be the perfect solution and ideal solution for you. Submit your personal details through our secure application process and receive a decision within minutes. With Rixloans, you can access money for emergencies quickly and conveniently.

With a range of options available, you can find the perfect solution to cover any gaps between paychecks that may arise from unexpected medical expenses or other financial challenges. You can pay back within two weeks or as soon as your next payday, whichever is sooner. Some lenders are willing to offer a wide range of repayment options that last between thirty and forty-five days.

Filling out loan request forms is easy, and the entire process can be completed in a matter of minutes. Say goodbye to lengthy application processes, as many lenders have minimal requirements and basic requirements that allow for quick approval.

By applying for the same day payday loan online, you’ll gain access to funds quickly, so you can easily make an informed borrowing decision. Flexible eligibility requirements mean that you can secure the funds you need in just a matter of minutes without having to jump through hoops.

Conclusion

In the realm of payday loan regulations, Arkansas has opted for a moderate stance. They’ve set the payday loan APR at a maximum of 300%, which, while being lower than states like Texas, Oklahoma, Missouri, and Mississippi without any caps, is still relatively high when pitted against other states. The landscape sees continuous efforts from advocates aiming to further reduce these rates, but lenders emphasize the need for slightly elevated caps to ensure service accessibility. Additionally, the state has a policy that restricts residents to only five payday loans a year. As the dialogue on the best regulatory approach persists, entities keep presenting short-term financing choices compliant with existing regulations.

Frequently Asked Questions

Are payday loans in Arkansas legal, and what are the regulations surrounding them?

Yes, payday loans are legal in Arkansas with some regulations. Lenders must be licensed, loans cannot exceed $400, fees cannot exceed 17% of the loan amount, and loans must be due in 14-31 days.

How do I apply for a payday loan in Arkansas without a credit check?

You can apply in person at a payday lender with ID, proof of income, and a bank account. Online applications only require ID, income info, and account details. No credit check is required.

What is the maximum loan amount I can get through an instant cash payday loan in Arkansas?

The maximum payday loan amount allowed in Arkansas is $400. Lenders cannot legally issue a payday loan exceeding $400.

What are the typical interest rates and fees associated with payday loans in Arkansas?

Typical APR on Arkansas payday loans is 391% with max fees of $45 on a $350 loan. This equals 17% of the loan amount, the max allowed by law.

Are there any alternatives to payday loans in Arkansas for obtaining instant cash in a financial emergency?

Alternatives include pawning items, borrowing from friends/family, credit cards, employer cash advances, credit union loans, and negotiated bill payments.