Kansas Payday Loans – Online With Bad Credit

RixLoans’ Kansas payday loans are crucial for many people in Kansas, especially those with a bad credit score. People use them when they require a cash advance loan in an instant, usually to handle a financial situation or an unexpected expense. Instead of banning them altogether, Kansas has several restrictions for these short-term loans.

Kansas State puts specific restrictions on the borrowers to ensure they do not fall into a circle of debt. It also limits the use of these readily available credit alternatives, ensuring they have a loan request approved within one business day.

What Are the Payday Loan Restrictions in Kansas?

Kansas payday loans should have a minimum repayment period of 30 days, offering flexible repayment terms. Kansas lenders for payday loans must be approved by the State Bank Commissioner’s Office and adhere to every law governing the loans. For instance, unlike a traditional loan, they cannot offer multiple cash advances to the borrower in the same transaction. The online application process makes it easier for borrowers to access online lenders.

What Is the Cost of a Payday Loan in Kansas?

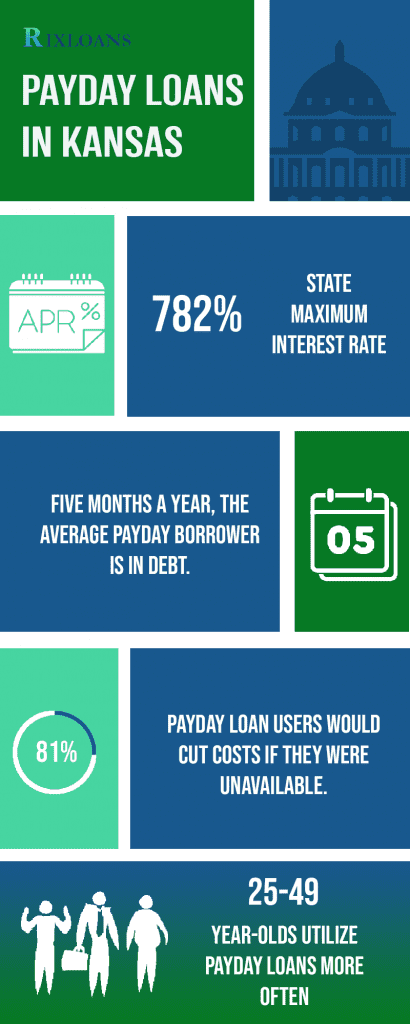

The cost of a payday loan in Kansas depends on the loan terms and the amount borrowed. Borrowers must provide proof of income to ensure they can repay the loan, even with poor credit scores. Lenders consider late payments and other factors to determine the loan amount and interest rate. To find a reputable lender, it’s essential to research and compare different loan websites and the various types of loans they offer. With a proper understanding of the costs involved, borrowers can choose the best option for their financial emergency or unexpected expense.

The most excellent protection is related to the charges imposed by lenders. They cannot charge higher than 15 percent of the number of cash advances. For a passage of $500, the highest amount a lending firm can charge is $74.

What Do I Need to Know About Payday Loans?

You can get online loans for up to $1000. Once we approve your loan application, RixLoans will send the money to your bank account within 24 hours. Flexible loan amounts make it easier for borrowers to manage their finances. The borrower receives a “funded” account if there is a form of credit.

They can use the account to make frequent transfers based on their needs until they meet the credit limit. Flexible repayment options are essential for managing the loan effectively. Repayments are made on a predetermined pay period.

The lender may close the account after the borrower has cleared the balance. This eliminates the requirement to apply for this type of loan once more.

What Should I Consider Before Applying For Payday Loans in Kansas City?

Before applying for a day payday loan or instant payday loans, it’s essential to consider several factors, such as loan approval times and eligibility criteria. Ensure that you are a permanent resident and meet the requirements set by the lender. Lenders may also accommodate bad credit borrowers who need emergency cash, providing quick cash with quick approvals and instant decisions.

Filling out an online form can streamline the application process, allowing borrowers to receive loans faster. However, lenders may impose Limited loan amounts for first-time borrowers or those with poor credit reports. Finally, always aim to repay the loan on time to avoid additional fees or penalties.

Understand the rates and terms of Kansas City payday loans before borrowing. Because the loans are not as complicated as typical bank products with higher restrictions, they offer a wide range of options and are simple to obtain.

Here are some of the most crucial facts concerning payday loans in Kansas that everyone should be aware of.

Costs

When applying to payday loan online providers in Kansas City, the lender will tie all costs at one rate, the APR. They offer an excellent choice for borrowers, including bad credit providers seeking extra cash.

The Time Frame for Approval

Instant loans are a viable option for those who need quick cash. Expect to get an approved notification from the payday loan providers within minutes of applying since lenders independently evaluate applications through algorithms. This allows borrowers to make informed decisions about their loans. The loan agreement is signed, and the documents are verified within one day. The money is distributed via an automatic deposit and can reflect within 24hrs.

The Same-Day Approvals Are Available

Payday loans in Kansas have Flexible Terms and Eligibility Requirements that vary across different loan offers. Typically, a minimum credit score is not required, but a regular income is essential. These loans cater to a range of loan amounts and are offered to customers with different credit ratings to ensure accessibility. Minimal paperwork and instant approval make them the perfect choice for emergencies and urgent financial needs.

It is possible to receive Kansas online payday loans within the same day. Check the lender’s website to determine if they have this prioritization service. It’s essential to apply early if you need same-day approval.

All credit types are eligible for payday loans in Kansas City. RixLoans have no requirement to have good credit scores. The primary consideration is the borrower’s capacity to repay the loan, not necessarily their less-than-perfect credit scores or bad credit history.

We are delighted to present a comprehensive list of the key cities where our company, RixLoans, is actively providing payday loan services in Kansas. With a strong commitment to meeting the financial needs of individuals and families, we have established a presence in these vibrant communities to offer reliable and accessible financial solutions. Whether you require immediate assistance or seek flexible borrowing options, our dedicated team is here to assist you. Below is a table showcasing the most important cities in Kansas where our services are available, enabling you to access the support you need conveniently.

| Wichita | Overland Park | Kansas City |

| Olathe | Topeka | Lawrence |

| Shawnee | Lenexa | Manhattan |

| Salina | Hutchinson | Leavenworth |

| Leawood | Dodge City | Garden City |

What Are Lenders’ Requirements for Payday Loans?

The state capital of Kansas is Topeka. Payday loans are also available from a network of lenders. To evaluate an applicant’s eligibility, lenders look at the following factors.

Legal Status

Applicants must be at least 18 years old and a legal resident of the United States.

Period of Time and Loan Amount Range

Quick payday loans can be obtained for a short period of time, typically two to four weeks. Lenders often have a loan amount range from which borrowers can choose based on their needs.

Application Forms and Loan Request Forms

Lenders require applicants to complete application forms and loan request forms to provide essential information and assess the borrower’s eligibility.

Unemployed Borrowers and Loans to Customers

While some lenders may require proof of income, others may also offer loans to customers who are unemployed borrowers or have alternate sources of income.

Provider of Payday Loans and Online Lending Platform

RixLoans is a reliable provider of payday loans that operates on an online lending platform, making it convenient for borrowers to access various loan options.

Approval Rate and Loan Decision

The approval rate for payday loans can vary depending on the lender. Still, many providers offer a fast loan decision process to determine whether a borrower is eligible for a loan quickly.

Financial Solution and Lending Option

A payday loan can be a suitable financial solution for individuals needing quick cash. The borrower should consider various lending options and choose the one that suits their needs.

Loan Contract

Once the borrower has agreed to the terms, they will typically be asked to sign a loan contract outlining the loan’s conditions, repayment terms, and possible penalties for non-payment.

The applicants must reach the minimum age of majority and live within Kansas during the application period.

An Established Source of Income

To qualify for payday loans, applicants must provide evidence of an ongoing and reliable monthly income sufficient to repay the loan. A steady source of income is crucial for loan approval since there could be a lengthy application process involved. Some alternative providers could offer a more convenient solution by releasing the loan funds faster.

Active Bank Account

A typical loan company distributes funds through direct deposits. Therefore, borrowers must have a valid checking account. There might also be a minimum credit score requirement in some cases. Lenders usually check for a history of minimum payment and any missed payments before approving a loan.

What Are the Alternatives to Payday Loans?

Several other options are available to those in a tight financial spot. Here are the typical alternatives to payday loans:

These alternative loans could be an ideal choice or an option for people facing financial difficulties, including unemployed people. Having a legal residency to qualify for such loans is essential. Choosing an ideal option after considering the pros and cons of each loan type can lead to a more convenient option for borrowers.

Many lenders might also provide additional services, like filling out a loan application form to guide you through the process. Furthermore, they might help assess your loan eligibility based on your financial history in their lending decisions.

Lastly, having a valid bank account is necessary to ensure that you can access funds easily. This would allow lenders to transfer funds through direct deposit without hassle.

- Time payments: Credit cards offer similar services as payday loans but have higher interest rates. They also carry more risk because they charge a fee each time you purchase.

- Perfect choice – Bank loans: Banks often offer low-interest personal loans to customers with strong credit histories. However, these loans usually come with high monthly payments, which the government doesn’t guarantee.

- Perfect solution – Personal loans: Private companies offer personal loans with minimal requirements and are secured by your home. Because these loans are secured by real estate, they typically carry lower loan interest rates than unsecured loans.

- Loans from friends or relatives: Friends and relatives can help when you need money in urgent situations, but only if you ask them first. There is no guarantee that they will agree to give you a loan, and they could end up costing you more than you would have paid for a payday loan.

- Instant payday loan companies: These companies offer quick and convenient borrowing options for payday loans. With a streamlined payday loan application process and competitive rates, it’s easier to get a loan when you need it.

- Reputation Score and Quick Ratings: Top-rated lenders usually have excellent customer service and a high reputation score, making them a reliable option. These lenders also typically offer many loan products, including maximum loan amounts and periodic payment schedules.

- Loan amount offering: Different lenders provide varying loan amounts based on factors such as your credit history, steady income, and other qualifications. Compare your options and find a lender that meets your needs.

- Options for payday loans: Considering factors like major credit bureaus reporting and special loan features, it’s essential to research the available options for payday loans to make the best decision for your financial situation.

So, consider all the possibilities, pay attention to excellent customer service, and choose the most suitable option according to your needs.

What Are the Advantages of Direct Lenders’ Payday Loans?

- Payday loans are a convenient loan solution. You don’t have to wait around for days before getting approved. The application process takes just minutes, and you can get cash within 24 hours, making them ideal as hour payday loans.

- Competitive interest rates. RixLoans offers better interest rates than most traditional payday loans lenders in the industry. If you apply, you will save more on interest rates than on a regular payday loan.

- RixLoans payday loans provide fast access to funds, acting as a reliable source for payday loans. When you apply for a payday loan, you can expect approval within an hour. Once you do, you can use the money right away.

- Payday loans allow you to avoid costly overdrafts even with a limited credit history. When you borrow money through a payday lender, you cannot write checks against your account. Instead, you must deposit enough money into your bank account to cover your expenses.

- Access to loan-matching services and bad credit loans results from direct involvement with a financial services provider. Financial institutions and loan lender services like RixLoans can provide quick loans through their lending company to help you meet your financial needs.

Conclusion

In a groundbreaking move, Kansas introduced a unique regulation that caps payday loan rates at a 100% APR, and simultaneously offers the provision for monthly installments of up to $1,000. This visionary model is designed to serve urgent financial needs, ensuring rigorous rate controls that differentiate it from the methods adopted by neighboring Missouri and are more cost-beneficial than Oklahoma‘s standards. There’s a segment of consumer advocates that favor the elimination of payday loans, much like Nebraska’s stance, or the establishment of even stricter rate caps. However, Kansas authorities are convinced they’ve found the sweet spot between providing for urgent needs and ensuring affordability.

Frequently Asked Questions

Can I really get guaranteed approval for payday loans in Kansas without a credit check?

Guaranteed approvals are exaggerated claims. Most legitimate Kansas lenders do soft credit checks. Consider alternatives before assuming approval is certain, even if marketed as guaranteed.

What are the eligibility criteria and requirements for obtaining payday loans in Kansas with guaranteed approval and no credit check?

Minimum requirements are ID, income verification, Kansas residency, and a bank account. However, creditworthiness is still evaluated in most cases despite marketing claims.

Are there any recommended reputable payday loan lenders in Kansas known for providing guaranteed approval options to borrowers without checking their credit?

Lenders may advertise guaranteed approvals but legitimate lenders still perform soft credit checks during the loan review process.

What are the typical interest rates and repayment terms associated with payday loans in Kansas for those seeking guaranteed approval and no credit checks?

Payday loan APRs in Kansas often exceed 300% even with guaranteed approval claims. Terms are typically 7-30 days, aligned with the borrower’s next pay date.

Are there alternative financial resources or assistance programs available to residents of Kansas who prefer payday loans with guaranteed approval and no credit checks?

Alternatives may include nonprofit credit counseling, paycheck advances from employers, borrowing from family/friends, credit union loans, and debt management plans.