New Mexico Payday Loans – Same-Day Cash

Payday loans are a helpful source of quick cash for people who need to cover unplanned expenses. But understanding the regulations and requirements surrounding payday loans in a specific state is needed to make informed borrowing decisions. The following article examines payday loans in New Mexico, including whether borrowers can obtain online payday loans, alternatives, maximum borrowing amounts, costs, consequences of non-payment, and more.

Summary

In New Mexico, payday loan lenders offer quick cash solutions to help borrowers cover unexpected costs, such as emergency expenses. These loans can be obtained online from various lenders, making it convenient for individuals to access funds when needed. However, it’s crucial to understand the rules and regulations surrounding payday loans in New Mexico to make wise borrowing decisions and avoid the consequences of non-payment.

- Payday loans are short-term loans for small amounts that provide quick cash to cover unexpected expenses until the borrower’s next payday. These are often considered a type of loan agreement.

- Payday loans are unsecured and granted based on the borrower’s ability to repay the loan, but they have high-interest rates and fees, making them a costly form of borrowing. They can also be called online loans when applied for through the Internet.

- The availability of payday loans, including online loans, varies from state to state, with certain states banning or restricting the practice entirely.

- Due to the state’s ban on payday lending, borrowers in New Mexico are not allowed to obtain payday loans, including online ones.

- Borrowers needing short-term cash in New Mexico must explore alternatives to payday loans and loan agreement options, such as personal loans, credit cards, or government assistance programs.

- Short-term loans are a larger form of borrowing than payday loans. They have more favorable terms, including lower interest rates and longer repayment terms, making them a better alternative to a typical loan agreement for payday loans.

- Understanding the laws and regulations surrounding payday loans, loan agreements, and online loans in a specific state and reviewing the terms and conditions of any loan is necessary for informed borrowing decisions.

What Are Payday Loans?

Payday loans are short-term loans that provide borrowers with quick cash to cover unexpected expenses until their next payday. They are for small amounts, ranging from a few hundred to a few thousand dollars, and are usually due within two to four weeks, depending on the borrower’s pay schedule. Payday loans are unsecured, meaning that they do not require collateral, and are usually granted based on the borrower’s ability to repay the loan.

But it’s best to note that payday loans are only available in some states in the United States. Many states have laws and regulations allowing payday lending, while others have banned or restricted the practice. The availability of payday loans varies within states, as localities have extra regulations in place.

Borrowers must know that loan rates for payday loans have high-interest rates and fees, which make them a costly form of borrowing. Many payday loan borrowers end up in a cycle of debt, applying for new payday loans to cover the costs of previous ones. People must only see payday loans as a last resort because of the risks of such financial solutions with high loan rates.

Can Borrowers Get A Payday Loan Online In New Mexico?

No, borrowers are not allowed to obtain payday loans online in New Mexico as the state has banned payday lending. The New Mexico Small Loan Act was amended in 2017 to cap interest rates and loan rates on small loans, effectively ending payday lending in the state. The law applies to all small loans, including the ones made online, and covers lenders operating in the state or lending to New Mexico residents.

Any lender attempting to offer payday loans in New Mexico, in-store or online, is breaking the law and must be avoided. But other lenders still try to skirt the law by offering installment loans or another high-cost lending that fall outside the definition of payday loans. Borrowers in need of short-term cash advances must check alternative forms of borrowing.

Borrowers must review the terms and conditions of any loan, regardless of the lender or type of loan, and only borrow what they can afford. Being aware of the laws in their state and understanding your loan options for borrowing help them make informed decisions about managing your finances during a financial crisis.

In the bustling landscape of New Mexico, our company has established a strong presence, catering to the financial needs of individuals seeking payday loans. As a reputable and trusted financial institution, we have strategically expanded our operations across the state, focusing on key cities where the demand for such services is significant. This table highlights the major cities in New Mexico where our company is actively engaged, empowering residents with convenient and reliable access to the financial support they require. With a commitment to serving our customers with utmost professionalism and care, we are proud to present this comprehensive overview of the vital locations where our services thrive.

| Albuquerque | Las Cruces | Rio Rancho |

| Santa Fe | Roswell | Farmington |

| Hobbs | Clovis | Alamogordo |

Alternatives To Payday Loans In New Mexico

Payday loans are an expensive and risky way to borrow money, and there are other options for short-term financing in New Mexico. There are several alternatives to payday loans, such as short-term cash advances that help borrowers get the funds they need without putting them at risk of further financial problems.

Exploring the alternatives allow borrowers to find a solution that fits their needs and budget and helps them avoid the high costs and potential pitfalls of payday lending. But it’s necessary to carefully review all options and compare the costs and terms of different loans before deciding. Doing so helps make an informed choice and avoid getting trapped in a cycle of debt. The payday loan alternatives are listed below, focusing on ensuring financial stability, adhering to lending laws, and providing an affordable option.

- Personal loans – Borrowers use loans for various purposes, such as paying off high-interest debt, financing a home renovation project, or covering unexpected expenses. Banks, credit unions, or online lenders offer personal loans with lower interest rates and longer repayment terms. Personal loans do not require collateral, meaning borrowers do not have to use their property as security. But other lenders offer secured personal loans that require collateral, such as a car or a savings account.

- Credit cards – Credit cards are a form of borrowing money that borrowers use as an alternative to payday loans in New Mexico. They are a useful tool for short-term borrowing, especially for people with unexpected expenses or needing to cover bills before their next paycheck. But using credit cards responsibly and paying off the balance in full each month is necessary to avoid high-interest charges. Borrowers need to compare interest rates and fees when looking for a credit card to use as an alternative to payday loans. Look for cards with low-interest rates and no annual fees to save money on borrowing costs. Certain credit cards offer rewards programs or cashback incentives that provide added benefits.

- Government assistance programs – Government assistance programs are financial aid offered by the government to help individuals and families struggling to make ends meet. The programs are designed to provide temporary or ongoing support to low-income households, individuals with disabilities, and people experiencing financial hardship due to unexpected circumstances. Several government assistance programs in New Mexico are available to eligible residents, such as Supplemental Nutrition Assistance Program and Low Income Home Energy Assistance Program.

Short-Term Loans Vs. Payday Loans

Short-term loans and payday loans are both types of borrowing intended to be repaid within a short period, usually a few weeks to a few months. But borrowers must know the key differences between short-term and payday loans. Short-term loans are larger loans that have more favorable terms than payday loans. They are available from banks, credit unions, or online lenders. Interest rates on short-term loans vary depending on the lender and the borrower’s creditworthiness, but they are generally lower than payday loans. Short-term loans have longer repayment terms, allowing borrowers to transfer payments over several months.

Payday loans are smaller loans meant to be repaid in full on the borrower’s next payday. They are unsecured and available from storefront or online lenders specializing in payday lending. Interest rates on payday loans get very high, with certain lenders charging APRs of 400% or more, according to Consumer Financial Protection Bureau. Payday loans are difficult to repay and lead to a cycle of debt because of their short repayment terms and high costs.

How Long Does It Take To Get Approved For A Short-term Loan In New Mexico?

Payday loans have become popular for those with a bad credit history as they often don’t require a credit check. A direct lender can offer cash advances to help with short-term financial needs. These payday loan services typically provide quick approvals, with some lenders approving loans in as little as a few minutes to an hour. However, borrowers should be cautious when opting for payday loans due to their high-interest rates and potential risks.

The time it takes to get approved for a short-term loan in New Mexico varies depending on the lender and the type of loan. Certain lenders can approve borrowers in a matter of minutes, while others take several days to review an application and make a decision. Online lending has become increasingly popular, as online and alternative lenders can approve loans more quickly than traditional banks or credit unions. They use online applications and automated underwriting processes to speed up loan approvals. Borrowers who apply in person at a bank or credit union need to provide added documentation and wait longer for a decision.

Borrowers must check if they meet the lender’s eligibility requirements and have all the necessary documentation ready when they apply to improve their chances of getting approved quickly. It includes proof of income, identification, and other financial information. Also, borrowers must attempt the online application process, if available, to save time on approval. Borrowers must compare rates and terms from multiple lenders to find the best loan for their needs and budget.

Maximum Amount That Can Be Borrowed With A Short-term Loan In New Mexico

The maximum short-term loan amount in New Mexico is $10,000, according to Buckley. But not all lenders offer loans up to this amount, and borrowers need to meet certain eligibility requirements, such as having a certain credit score requirement or a steady income level. Even though a lender offers a maximum loan, borrowers can still borrow the full amount. Borrowers only need to obtain what they need and what they afford to repay. Considering the maximum repayment term and payment amounts can help borrowers make informed decisions. Applying for more than they need results in higher costs and makes it more difficult to repay the loan on time.

Costs of Short-term Loans

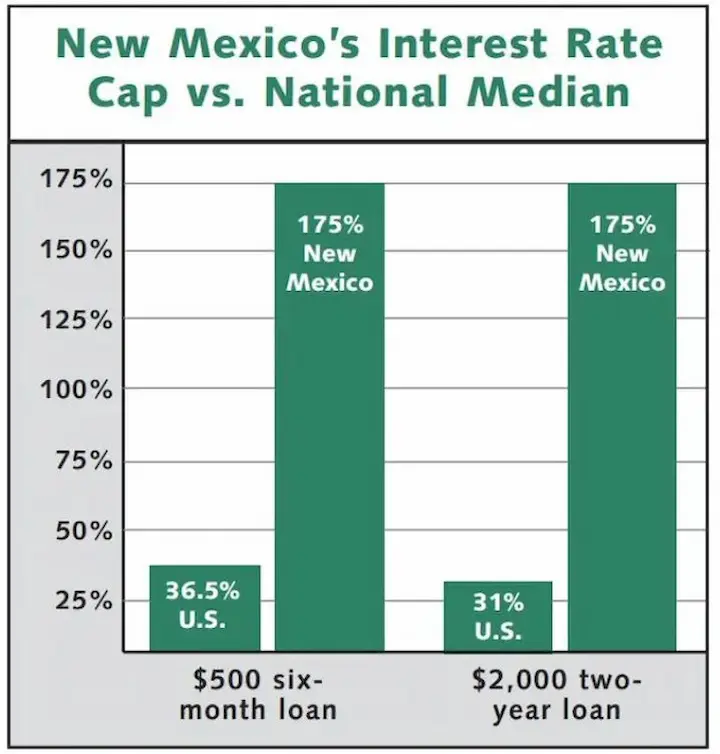

The costs of short-term loans in New Mexico vary depending on the lender, the loan amount, and the borrower’s creditworthiness. Short-term loans have higher interest rates and fees than traditional ones, making them more expensive for borrowers. The interest rate on short-term loans In New Mexico is capped at 175% APR, according to UStatesloans.org. But the actual rate depends on several factors, such as the borrower’s credit score.

| Borrower’s Credit Score | Short-Term Loan Interest Rate |

|---|---|

| 550 – 600 | 150% APR |

| 600 – 650 | 125% APR |

| 650 – 700 | 100% APR |

| 700 – 750 | 75% APR |

| 750 – 800 | 50% APR |

The table above shows how the interest rate on short-term loans in New Mexico varies based on the borrower’s credit score. But it only provides hypothetical scenarios based on the borrower’s credit score. Each row in the table represents a different range of credit scores and the corresponding interest rate for a short-term loan. For example, a borrower with a credit score between 550 and 600 receives an interest rate of 150% APR, while a borrower with a credit score between 750 and 800 receives an interest rate of 50% APR.

It’s necessary to note that the actual interest rate a borrower receives depends on other factors such as income, debt-to-income ratio, and the loan amount. But the table provides a general idea of how the interest rate varies based on credit score alone.

Consequences Of Not Repaying A Short-term Loan In New Mexico

The consequences of not repaying loan products like short-term loans in New Mexico are severe and result in a cycle of debt and financial hardship for the borrower. The financial institution or lender charges late fees and other penalties if borrowers fail to repay a short-term loan on time. They report the borrower’s delinquency to credit bureaus, which hurts the borrower’s credit score and makes it more difficult to obtain credit in the future. The lender takes legal action to collect the debt, which results in wage garnishment, bank account levies, or even a lawsuit.

Certain lenders offer to roll over or renew the loan, extending the loan term and adding more fees and interest if the borrower cannot repay the loan. It creates a cycle of debt, where the borrower continues to apply for new loan products to repay the old ones, and the debt continues to grow.

How to Apply for a Short-term Loan in New Mexico?

Borrowers must understand the financial products and the short-term loan application process because it helps them make informed financial decisions. Knowing the requirements and steps in applying for a short-term loan allows borrowers to prepare their documents and information beforehand. Doing it saves them time and reduces the likelihood of errors or delays in the application process. Below are the steps to apply for a short-term loan in New Mexico through a Loan agency offering various financial products.

- Research lenders. Borrowers must research lenders to find a reputable and reliable lender that offers short-term loans. They must check the lender’s reputation, reviews, interest rates, and terms and conditions. Ensuring that the chosen lender is a valid bank or financial institution is essential.

- Gather necessary documents. Borrowers must gather the necessary documents to apply for a short-term loan. They need proof of income, a valid ID, and a bank account with a valid bank.

- Fill out the application. Borrowers must complete an application form with their personal information, employment details, and loan amount. They can do it online or in person at the lender’s office, a valid bank, or another lending institution.

- Wait for approval. Borrowers need to wait for approval once they have submitted their applications. Lenders conduct a credit check, and the approval process takes a few minutes to several days, depending on the lender or valid bank issuing the loan.

- Review the loan terms. Approved borrowers must review the loan terms, including the interest rate, fees, and repayment schedule. They need to understand the terms before accepting the loan from their selected valid bank or lender.

- Accept the loan. The lender or valid bank deposits the funds directly into the borrower’s bank account or provides a check or cash. Borrowers need to agree to the loan terms to receive the funds.

Can Borrowers Get A Short-term Loan Without A Job?

Yes. Borrowers can get a short-term loan without a job, but it is more challenging for them to get approval. Many lenders require borrowers to have a steady source of income, such as a job or regular benefits payments, to qualify for a loan. But other lenders accept other sources of income, such as disability payments, child support, or retirement benefits, when evaluating a borrower’s ability to repay the loan.

Borrowers must be honest and upfront about their income when applying for a short-term loan, as misrepresenting income results in default and legal consequences. Borrowers without a job need to look for alternative options, such as asking friends or family for a loan, seeking out nonprofit organizations that offer financial assistance, or exploring government programs for low-income individuals.

Do Borrowers Need Collateral To Get A Short-term Loan Through Lenders In New Mexico?

Short-term loans are unsecured, which means that borrowers do not need to provide collateral to get a loan. It is true for most lenders in New Mexico that offer short-term loans, including payday lenders, installment lenders, and online lenders. They look at a borrower’s income, credit score, and other factors to determine their ability to repay the loan. Borrowers get a short-term loan without putting up any collateral if they meet the lender’s eligibility criteria.

Many lenders in New Mexico offer secured short-term loans, which require borrowers to provide collateral, such as a car title or personal property, to secure the loan. Secured loans are easier for borrowers with poor credit or limited income, but they risk losing the collateral if the borrower defaults.

Conclusion

Through informed decision-making, New Mexico brought in payday lending reforms, leaning more towards rate caps as opposed to outright bans that some desired. Rates are pegged at 175% APR, which, though high, is a commendable step away from the once unregulated 1,000% APR. There’s an avenue for New Mexico to trim down these rates, but they’ve made commendable progress in shielding consumers from excessive abuse. When compared to states such as Texas, Oklahoma, Arizona, Utah, and Colorado, New Mexico’s commitment to transparency and regulation is evident as these states either have loftier caps or none at all. As reformists observe this, many believe New Mexico’s strategy could serve as a benchmark for future enhancements, prioritizing progressive changes over all-out prohibitions. Some industry insiders, however, believe the rate cap could stand a slight increase without negatively impacting consumers.

Payday loans are a helpful source of quick cash for people who need to cover unexpected expenses. However, understanding the regulations and requirements surrounding payday loans in a specific state is needed to make informed borrowing decisions. Payday loans are unavailable in New Mexico, as the state has banned payday lending. The New Mexico Small Loan Act was amended in 2017 to cap interest rates on small loans, effectively ending payday lending in the state.

There are several alternatives to payday loans in New Mexico, including personal loans, credit cards, and government assistance programs. Borrowers must carefully review all the options and compare the costs and terms of different loans before deciding. Doing so helps make an informed choice and avoid getting trapped in a cycle of debt.

Frequently Asked Questions

Are there online lenders in New Mexico that offer payday loans for individuals with bad credit, and how can I apply for one?

Yes, many online lenders in New Mexico offer payday loans to those with bad credit. You can apply on lender websites by submitting personal and income information.

What are the typical interest rates and repayment terms associated with online payday loans in New Mexico for individuals with bad credit?

Payday loan APRs in New Mexico average 340% but can exceed 500%, with repayment usually due by the borrower’s next paydate.

Can you explain the eligibility criteria for obtaining payday loans in New Mexico with bad credit, and what documentation might be required?

Lenders usually require ID, income verification, bank details, and residence in New Mexico. Formal credit checks are not typically part of the approval process.

Are there any state-specific regulations or consumer protections in New Mexico regarding payday loans for individuals with bad credit?

New Mexico caps loan amounts at 25% of gross monthly income or $500, whichever is less. Multiple rollovers are also prohibited.

How can I find reputable online lenders in New Mexico known for providing payday loans to individuals with bad credit?

Well-reviewed New Mexico online payday lenders accepting bad credit applicants can be found online.